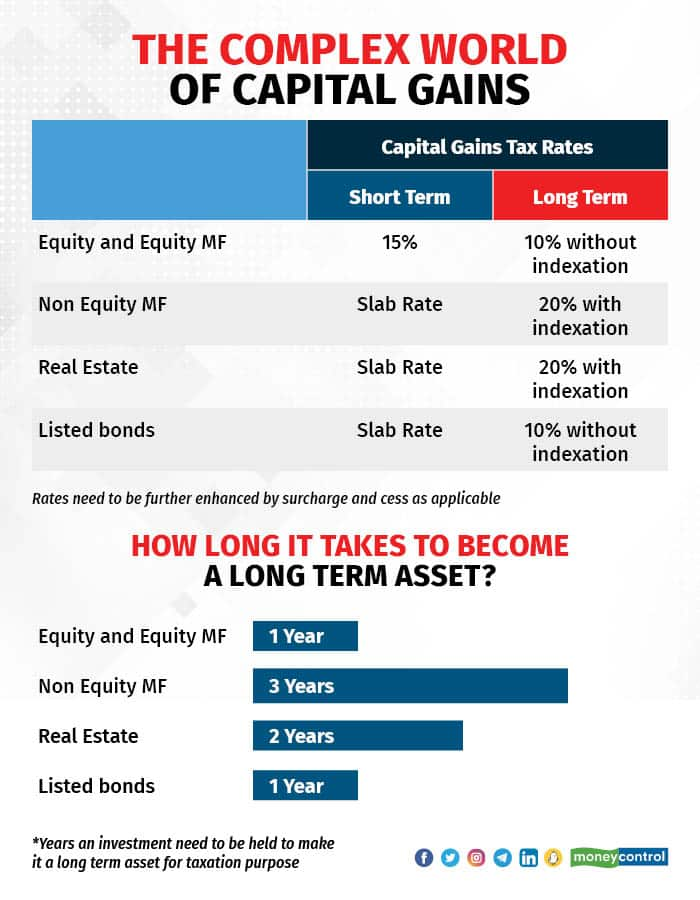

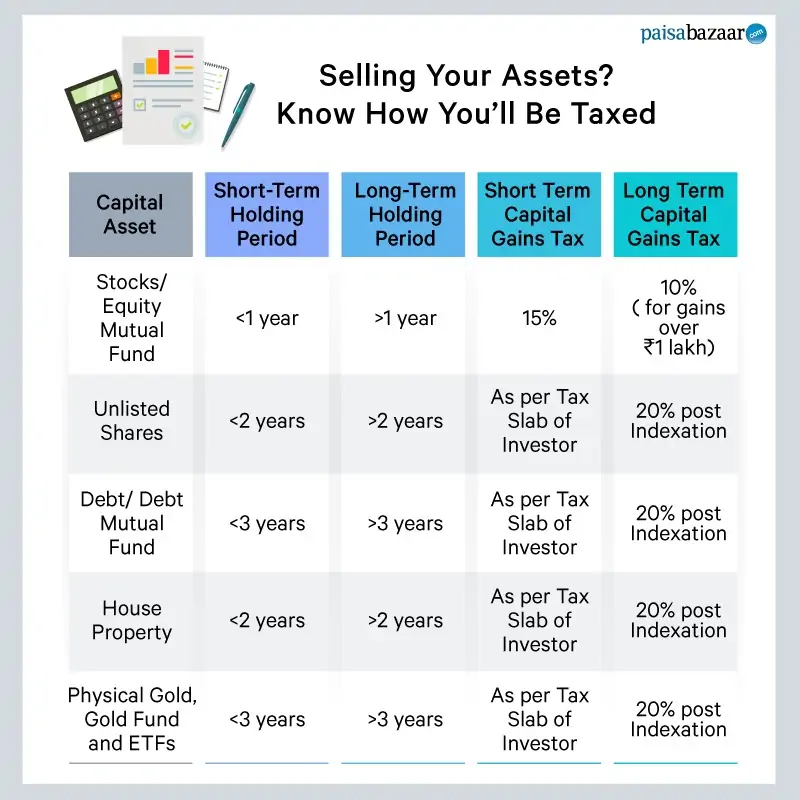

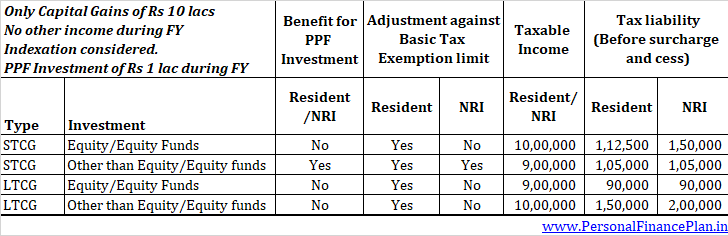

Capital gains are the profits you make from selling your investments, and they can be taxed at lower rates | Business Insider India

Budget 2023 Expectations: Shorter holding period for non-equity funds, hike in equity LTCG limit to Rs 2 lakh

Capital gains tax regime needs to be tweaked: Revenue secretary Tarun Bajaj | Economy & Policy News - Business Standard

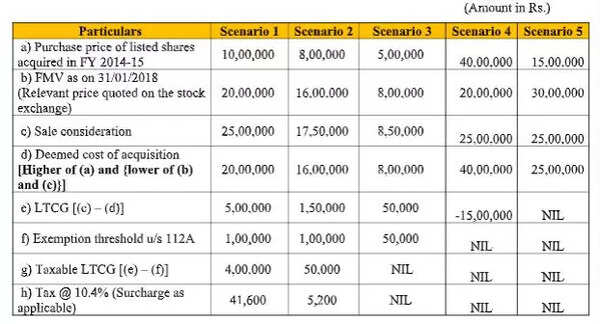

TaxHelpdesk - Long-term capital gains that fall under Section 10(38) of the Income Tax Act, as stated earlier, were not taxable earlier. However, after the reforms made in the Union Budget 2018-19,

![Taxation on Short Term Capital Gains | Income Tax on STCG @15% [Examples] - YouTube Taxation on Short Term Capital Gains | Income Tax on STCG @15% [Examples] - YouTube](https://i.ytimg.com/vi/b3Ni2ZJzpkE/maxresdefault.jpg)